Introduction: From Strategy to Action

If you’ve read our guide on Annuity Laddering Strategies: How To Maximize Income & Flexibility, you already understand the benefits of annuity laddering—steady income, inflation protection, and financial flexibility. But knowing what it is isn’t enough. Now it’s time to turn theory into practice.

In this post, we’ll walk you through how to build your own retirement income plan using annuity laddering—step by step.

🔑 What Is a Retirement Income Plan?

A retirement income plan is a personalized strategy to ensure that your expenses are covered for the rest of your life without outliving your savings. This plan typically includes:

- Social Security

- Pensions (if available)

- Personal savings/investments

- Annuities

Adding laddered annuities to this mix can help cover essential expenses while preserving growth opportunities for later years.

🧱 Step-by-Step: Build Your Annuity Ladder-Based Income Plan

1. Determine Your Retirement Budget

Start by listing your essential monthly expenses: housing, healthcare, food, transportation, etc. Then factor in discretionary spending like travel, entertainment, or hobbies.

Tip: A good rule of thumb is to cover essential expenses with guaranteed income sources.

2. Identify Guaranteed Income Sources

These may include:

- Social Security

- Pension

- Rental income

Subtract this amount from your essential expenses. The gap will help you determine how much annuity income you need to generate.

3. Choose Ladder Intervals Based on Your Age

Let’s say you’re 60 and want income to start at 65, then boost again at 70 and 75.

You can purchase:

- A 5-year annuity to begin at 65

- A 10-year annuity to start at 70

- A 15-year annuity for age 75

This approach spreads your income “ladder rungs” and ensures higher future payouts due to delayed start dates.

4. Diversify Annuity Types

Depending on your goals and risk tolerance, consider:

- Fixed Deferred Annuities for predictable income

- Fixed Indexed Annuities for moderate growth tied to market performance

- Immediate Annuities if you need income right away

🔗 Helpful Resource: Understanding Different Types of Annuities

5. Review Tax Implications

Remember: annuity payouts may be partially taxable. Consider consulting a retirement tax advisor.

💡 Pro Tip: Use tax-advantaged accounts like IRAs or Roth IRAs when buying annuities to optimize tax treatment.

📊 Real-World Example

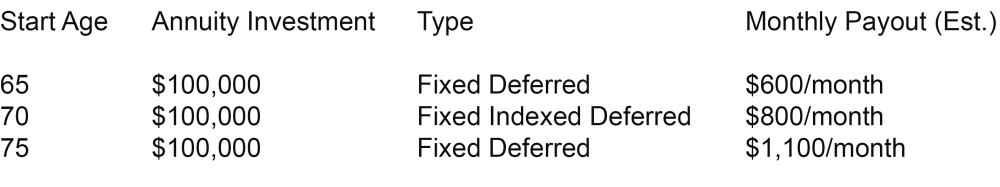

Meet Lydia, age 60, with $300,000 to allocate for retirement income. She structures her annuity ladder like this:

By laddering these annuities, Lydia:

By laddering these annuities, Lydia:

- Locks in guaranteed income

- Maximizes payouts over time

- Keeps flexibility in the early years of retirement

🎯 Final Checklist

Before you commit:

✅ Identify your income gap

✅ Set up 3–5 annuity rungs with staggered start dates

✅ Consult a licensed annuity advisor

✅ Diversify annuity types for flexibility

✅ Ensure tax efficiency

📌 Why This Strategy Works

Annuity laddering:

- Mitigates interest rate risk

- Matches income with life stages

- Avoids locking all your funds into one contract

- Balances security and growth

It’s not just about guaranteed income—it’s about peace of mind.