📝 Meta Description:

📝 Meta Description:

Discover why annuities are booming in 2025. Learn how they offer guaranteed income, protect against inflation, and become a smart addition to your passive retirement plan.

🏷️ Tags: annuities, passive income, retirement planning, financial stability, secure act

Why Annuities Are the New Retirement Anchor in 2025

As economic uncertainty looms and traditional portfolios face new risks, annuities are stepping into the spotlight as a smart, reliable tool for retirement income. In 2024, U.S. annuity sales hit a record $434 billion, and that growth is continuing into 2025.

Why the sudden surge in interest? Let’s break down what’s fueling the annuity revival—and how you can use them to build a stronger, more predictable retirement paycheck.

🔥 What’s Fueling the Annuity Surge?

✔️ Market Volatility Fatigue

After years of unpredictable returns, investors are looking for stability and guaranteed income, and annuities provide both.

✔️ Longevity & Inflation Worries

Today’s retirees face the dual risks of living longer and paying more. Modern annuities address both through lifetime payouts and inflation-adjusted income options.

✔️ Easy Access via Tech Platforms

New digital-first providers like Blueprint Income and Gainbridge have made annuities easier to compare and purchase online.

✔️ SECURE Act 2.0 & Regulation Support

New rules have encouraged annuity adoption inside workplace retirement plans and IRAs.

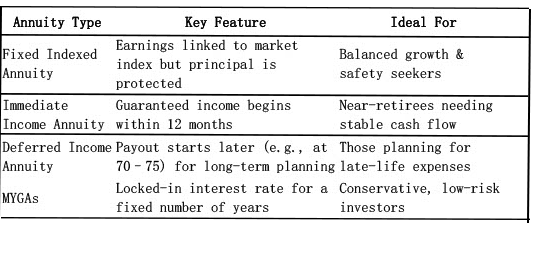

💡 Annuity Options You Should Know in 2025

🎯 How Annuities Fit into a Passive Income Strategy

🎯 How Annuities Fit into a Passive Income Strategy

Think of annuities as the “paycheck” component of your portfolio. They provide guaranteed income to cover essentials—while your other assets (dividends, real estate, funds) deliver growth and flexibility.

✅ Pro Tip: Consider laddering annuities—buying several with different start dates—to create income streams that activate over time.

🚩 Watch Out For These Red Flags

- High fees (especially in variable annuities)

- Long lock-in periods with surrender charges

- Lack of inflation protection (unless added)

Always compare providers and read the contract details carefully. Better yet, consult a fee-only fiduciary advisor.

✅ Final Thoughts: Are Annuities Right for You?

If you want peace of mind, predictable income, and protection from outliving your savings, annuities deserve a serious look in 2025.

They’re no longer just insurance products—they’re becoming the backbone of modern, diversified retirement strategies.

📥 Download: Free Annuity Evaluation Worksheet

Free Annuity Evaluation Worksheets

- 📄 Kansas Annuity Evaluation Worksheet (Writable PDF)

Great for evaluating annuity contract terms, surrender values, and payout options.

👉 Download Now - 📄 Crump Life Insurance Annuity Needs Analysis Worksheet (PDF)

Helps users assess income needs, risk tolerance, and ideal annuity types.

👉 Download Now