Navigating the landscape of retirement planning involves envisioning it as a puzzle, where assembling a diverse mix of elements is key to fostering both financial growth and security. This intricate blend should align with your financial goals, risk tolerance, and the timeframe until your retirement. As we explore deeper into how to manage your retirement options, skepticism may arise. You’re often advised to diversify your investments based on your financial goals, risk tolerance, and the time until retirement. However, questioning the validity of this advice is essential. Let’s dissect the complexities and discern whether these strategies genuinely cater to your best interests.

The Skeptic:

Vague Financial Goals:

First, you’re supposed to figure out what you want in retirement. Are these goals realistic, or are they just selling you a dream? How do you even know what you’ll want years from now?

The Realist

Understand Your Financial Goals:

Clarify your retirement goals, such as the desired lifestyle, travel plans, and any major expenses you anticipate.

Consider your time horizon until retirement and any specific financial objectives.

Scenario: Sarah, a 40-year-old professional, envisions a comfortable retirement that includes travel and maintaining her current lifestyle. She calculates her expected retirement expenses and sets specific financial goals, such as having a certain amount saved for a down payment on a retirement home.

The Skeptic

Questionable Risk Tolerance:

So, you’re expected to know how much risk you can handle. But isn’t risk just a fancy way of saying you might lose money? How do you predict your tolerance for financial ups and downs?

The Realist

Assess Your Risk Tolerance:

Determine how much risk you are willing to take on. Your risk tolerance will influence the mix of investments in your portfolio.

Generally, younger investors may have a higher risk tolerance as they have more time to recover from market fluctuations, while those closer to retirement may prefer a more conservative approach.

Scenario: John, a 30-year-old investor, assesses his risk tolerance by considering his reaction to market fluctuations. He determines that he is comfortable with some risk and can withstand short-term market volatility, making him more inclined to allocate a larger portion of his portfolio to stocks.

The Skeptic

Mixing Investments for What?

Diversifying your investments is promoted as the smart move. But does spreading your money around actually protect you, or is it just a way for financial advisors to cover all their bases?

The Realist

Include Bonds:

Diversification involves spreading your investments across different asset classes to reduce risk. Common asset classes include stocks, bonds, and alternative investments.

Include a mix of assets that have different risk-return profiles. For example, stocks may offer higher returns but come with higher volatility, while bonds may provide stability.

Scenario: Maria decides to diversify her retirement portfolio by including a mix of asset classes. She allocates 70% to a diversified stock portfolio, 25% to bonds for stability, and 5% to alternative investments like real estate investment trusts (REITs) to further diversify.

The Skeptic

Constant Adjustment:

They say you should regularly check and adjust your investments. Is this just a way to keep you constantly involved, or does it really make a difference? Maybe it’s just a game to make you feel in control.

The Realist

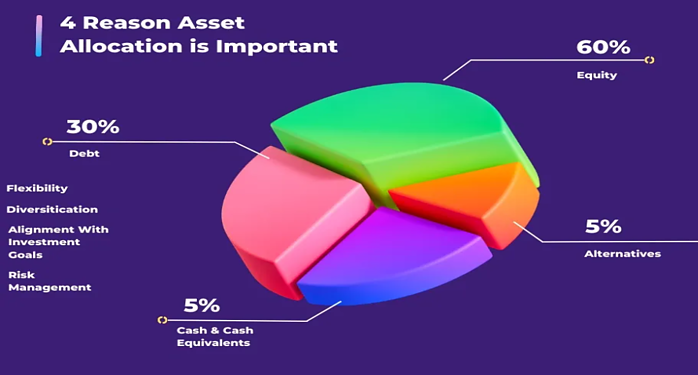

Consider Asset Allocation:

Determine the percentage of your portfolio allocated to each asset class. Asset allocation is a crucial factor in portfolio performance.

Rebalance your portfolio periodically to maintain the desired asset allocation. This may involve selling some assets and buying others to bring your portfolio back in line with your target allocation.

Scenario: Mike, nearing retirement, decides on an asset allocation of 60% in stocks and 40% in bonds. As market conditions change, he periodically rebalances his portfolio to maintain this allocation and ensure that his risk profile aligns with his retirement goals.

The Skeptic

Invest in What Can Grow, Really?

Investing in things that can grow sounds great, but aren’t those the same things that can also crash? How do you know what will really grow in the long run?

The Realist

Invest in Stocks:

Stocks have historically provided higher returns over the long term. Include a portion of your portfolio in diversified stock investments, such as through individual stocks or mutual funds.

Scenario: Emily, a 25-year-old investor, recognizes the long-term growth potential of stocks. She invests in a diversified mix of individual stocks and exchange-traded funds (ETFs) that track different sectors of the market to benefit from the potential appreciation.

The Skeptic

Safer Options or Slow Growth?

Safer options like bonds are pitched as stable, but isn’t that just another way of saying slow growth? Are you sacrificing potential gains for a false sense of security?

The Realist

Include Bonds:

Bonds are generally considered lower-risk investments compared to stocks. They provide income and stability to a portfolio.

Government bonds, corporate bonds, and municipal bonds are common types of bonds to consider.

Scenario: Robert, age 50, includes bonds in his portfolio to add stability and generate income. He invests in a combination of government and corporate bonds, focusing on those with varying maturities to balance yield and risk

The Skeptic

Annuities – Too Good to Be True?

Annuities are sold as a way to get regular income in retirement. Sounds too good to be true, right? Is this just another financial product designed to benefit the sellers more than the buyers?

The Realist

Explore Annuities:

Annuities can provide a steady stream of income during retirement. There are different types of annuities, including fixed, variable, and indexed annuities.

Consider consulting with a financial advisor to determine if an annuity aligns with your retirement income goals.

Scenario: Susan, at 60, is concerned about outliving her savings. She explores the option of a fixed annuity that provides a guaranteed income stream throughout her retirement. She consults with a financial advisor to determine the suitable annuity type for her needs.

The Skeptic

Emergency Money – Or Hidden Fees?

Keeping emergency money separate is recommended, but isn’t this just a way to lock you into certain investments? Are these emergency funds more about hiding fees than providing real security?

The Realist

Build Emergency Savings:

Maintain an emergency fund separate from your retirement investments to cover unexpected expenses without tapping into your long-term savings.

Scenario: James, a 35-year-old professional, establishes an emergency fund equal to six months’ worth of living expenses in a separate savings account. This fund serves as a financial cushion, allowing him to cover unexpected expenses without disrupting his long-term retirement savings.

The Skeptic

Regular Checks – Do You Have the Time?

Regularly checking and adjusting your plan is emphasized. But who has the time for that? Is this just a way to keep you hooked into the financial system, making changes that might not even matter?

The Realist

Regularly Review and Adjust:

Periodically review your retirement plan and adjust it based on changes in your financial situation, goals, and market conditions.

Reassess your investment strategy as you approach retirement to ensure it aligns with your income needs and risk tolerance.

Scenario: Chris, aged 45, reviews his retirement plan annually. He updates his financial goals, assesses his progress, and adjusts his investment strategy based on changes in his life circumstances, such as a salary increase or a major expense.

The Skeptic

Expert Advice – Or Sales Pitch?

Seeking expert advice is encouraged. But how do you know if they’re really experts or just salespeople pushing products that benefit them more than you? Can you trust their advice?

The Realist

Seek Professional Advice:

Consider consulting with a financial advisor to help you navigate the complexities of retirement planning. They can provide personalized advice based on your unique circumstances.

Remember that managing retirement options is an ongoing process, and staying informed about market trends and financial planning strategies is essential for long-term success.

Scenario: Alex, a 55-year-old nearing retirement, seeks guidance from a financial advisor. The advisor reviews Alex’s current financial situation, retirement goals, and risk tolerance. Together, they create a personalized retirement plan that includes investment strategies, tax planning, and income projections.

In conclusion, navigating the landscape of retirement planning can indeed seem complex and uncertain. The need to create a diversified and balanced portfolio tailored to individual financial goals, risk tolerance, and time horizon is emphasized as a fundamental strategy. However, as one examines the intricacies of these so-called strategies, there arises a legitimate question about whether these recommendations genuinely serve the best interests of individuals or if they are merely components of a sophisticated financial system. While the importance of careful consideration and periodic review remains, it is essential for individuals to approach retirement planning with a critical eye, seeking transparency and ensuring that the chosen strategies align with their unique financial circumstances and aspirations.

Question:

Ok so what happens to those that are unable to invest in stocks, bonds, those that have started saving late or was unable to. Isn’t affiliate marketing a very good solution?

Affiliate marketing can be a viable option for individuals who may not have the means to invest in traditional assets like stocks and bonds or who have started saving for retirement later in life. Here are some reasons why affiliate marketing might be considered a potential solution in such situations:

Low Barrier to Entry:

Affiliate marketing typically has a low barrier to entry. You don’t need a large upfront investment to start, making it accessible to individuals with limited financial resources.

Flexible Time Commitment:

Affiliate marketing allows for a flexible time commitment. This is particularly beneficial for individuals who may be starting late in their retirement planning and need an income-generating activity that can be pursued alongside other responsibilities.

No Product Creation or Inventory Management:

Affiliate marketers don’t need to create their own products or manage inventory. This reduces the operational complexities and costs associated with starting a business.

Potential for Passive Income:

Successful affiliate marketing campaigns can generate passive income over time. This is beneficial for those who may be starting late in their savings journey and want to supplement their retirement funds with a stream of ongoing income.

Global Reach:

Affiliate marketing has a global reach, allowing individuals to tap into a broad audience. This can be advantageous for those who are looking for income opportunities beyond local or regional markets.

However, it’s important to consider some key points:

Income Variability: Affiliate marketing income can be variable and may take time to build. It’s not a guaranteed source of income, and results can vary based on factors such as marketing strategies, product quality, and audience engagement.

Market Risks: While affiliate marketing doesn’t involve traditional investment risks, it still operates within the broader digital marketing landscape, which has its own set of risks and challenges.

Regulatory Compliance: Adhering to legal and ethical standards in affiliate marketing is crucial. It’s important to be transparent about affiliate relationships and comply with advertising regulations.

Diversification: Relying solely on affiliate marketing for retirement income may lack the diversification offered by traditional investment portfolios. Diversifying income streams is generally considered a prudent financial strategy.

While affiliate marketing can offer a solution for generating supplemental income, individuals should also explore a well-rounded approach to retirement planning. This might involve a combination of income sources, including savings, investments, and potentially affiliate marketing as a complementary stream. Seeking financial advice and creating a comprehensive retirement plan tailored to individual circumstances is advisable for long-term financial security.

Finally

It’s never too late to take control of your financial future. I’ve provided a comprehensive overview of strategies for managing retirement options, catering to those ready to implement traditional approaches and offering alternatives for individuals unable to pursue conventional assets like stocks and bonds or starting their retirement savings later in life.

Embracing Affiliate Marketing in Retirement with Wealthy Affiliate

Affiliate marketing is an ideal path for retirees to earn income and stay engaged. Wealthy Affiliate offers comprehensive training, essential tools, and a supportive community, making it perfect for beginners and seasoned marketers alike. Retirees can start with a free membership, follow structured training, build a website, and create quality content to monetize their expertise. Wealthy Affiliate provides the resources needed to succeed, allowing retirees to work flexibly and pursue their passions while enjoying retirement.

Membership Pricing:

Level Up with Wealthy Affiliate

Are you ready for the next level? Look no further than Wealthy Affiliate, the all-in-one platform designed to empower entrepreneurs like you. With a range of membership options tailored to suit your needs, there’s never been a better time to start or grow your online venture.

Starter Membership: Start For Free

- Price: $0/month

- Key Benefits:

-

- Access to Wealthy Affiliate Starter features

- 1,500 AI Word Credits

- 1 Practice Website

- Limited Business Hub

- Core Niche Training (8 Classes)

- Limited Help & Support

Premium Membership: Unlock Premium Features

- Price: $41.58/month (Billed $499 yearly, save $91/year)

- Key Benefits:

-

- 1 Free .com domain ($16 value)

- 7,000 AI Word Credits per month

- Weekly Expert Classes

- Core Niche Training (20 Classes)

- Bootcamp Training (20 Classes)

- 3 Profit-Ready Websites

- Jaaxy Lite

- Unlimited Help & Support

- 24/7 Website Tech Support

Premium Plus+ Membership: Experience the Ultimate in Online Business

- Price: $58.08/month (Billed $697 yearly, save $491/year)

- Key Benefits:

-

- 2 Free .com domains ($32 value)

- 15,000 AI Word Credits per month

- Daily Expert Classes

- Core Niche Training (20 Classes)

- Bootcamp Training (20 Classes)

- 10 Profit-Ready Websites

- Jaaxy Enterprise ($99/mo value)

- Unlimited Help & Support

- 24/7 Website Tech Support

Comparison of Membership Levels:

- Business Hubs (Control Center): Starter (1), Premium (3), Premium Plus+ (10)

- AI Word Credits: Starter (1,500), Premium (7,000 per month), Premium Plus+ (15,000 per month)

- Expert Training Classes per year: Starter (50), Premium (350), Premium Plus+ (350)

- Managed WordPress Hosting: Starter (1 Site), Premium (3 Sites), Premium Plus+ (10 Sites)

- Max Monthly Website Visits: Starter (300), Premium (30,000), Premium Plus+ (300,000)

- .COM Domain Name Registration Included: Starter (1 Domain), Premium (1 Domain), Premium Plus+ (2 Domains)

- Website Storage: Starter (1GB), Premium (12GB), Premium Plus+ (60GB)

- Email Accounts: Starter (5 per site), Premium (10 per site), Premium Plus+ (10 per site)

- Jaaxy Research & Data Mining Platform: Starter (Pro), Premium (Pro), Premium Plus+ (Enterprise)

Why Choose Wealthy Affiliate?

With Wealthy Affiliate, you’re not just getting hosting – you’re getting a comprehensive suite of tools, training, and support to help you succeed online. From expert mentoring to advanced security features, we’ve got everything you need to thrive in today’s competitive digital landscape. So why wait? Level up your business today with Wealthy Affiliate.

Take a risk-free test drive with Wealthy Affiliate’s Starter Membership. This free account allows you to explore the platform, start building your business, and interact with millions of entrepreneurs without any upfront cost or credit card requirement.

Create Your “Test Drive” Starter Membership Here!

The Premium membership is the flagship, offering access to everything needed for online business success. Joining within the next 7 days grants you exclusive bonuses, including a

- 61% discount on your first month,

- a class on leveraging AI success in 2024, and personalized assistance.

Take Action:

Ready to unlock your online potential? Join the millions of successful entrepreneurs who have started or grown their businesses with Wealthy Affiliate. Sign up now and take advantage of our risk-free Starter Membership to explore the platform, start building your business, and connect with a community of like-minded individuals—no upfront cost or credit card required.

I’d love to hear from you! If you found this article helpful or have any questions, drop a comment below. Your insights and feedback help me improve and keep moving forward on my own affiliate marketing journey. Follow along as I share what works, what doesn’t, and everything in between. Let’s learn and grow together!