📆 Published: July 2025

📆 Published: July 2025

By RetireOnPassive.com | Retirement Income Planning Made Simple

✅ Meta Description:

Discover how annuity laddering in 2025 creates reliable retirement income, hedges inflation, and boosts flexibility. Learn strategies that work today.

🔑 Introduction

As we move through 2025, annuities have taken center stage in retirement planning. With economic uncertainty, rising interest rates, and increased longevity, retirees need income strategies that balance security with flexibility. That’s where annuity laddering comes in—a powerful tactic to maximize retirement income while keeping future options open.

If you’ve already read our beginner annuity planning guide or explored why annuities are crucial for retirement today, this is your next step toward smarter income planning.

🪜 What Is Annuity Laddering?

Annuity laddering is the process of purchasing multiple annuities at different times or with staggered start dates. The goal? Create a sequence of income streams that kick in over time—similar to how bond or CD ladders work.

Each annuity acts as a “rung” on your income ladder:

- Some provide immediate cash flow.

- Others defer income for higher payouts later.

- Some are used to lock in high interest rates for future needs.

This spread-out approach helps reduce interest rate risk, manage inflation, and build a flexible financial future.

📈 Why Annuity Laddering Works in July 2025

Take Advantage of Rising Interest Rates

Rates in 2025 are still adjusting. Buying all your annuities now could mean locking into lower payouts if rates climb later. Laddering lets you pace your purchases and capture better yields over time.

Plan for Inflation and Longevity

Inflation remains a retirement threat. Laddering allows you to delay some annuity start dates, increasing payouts in later years and acting as a built-in inflation hedge.

Build Flexibility Into Your Retirement Income

Life happens. Annuity laddering means you’re not locked into a single contract. You retain the ability to:

- Reallocate money in the future.

- Choose new products as your goals evolve.

- React to changing economic conditions.

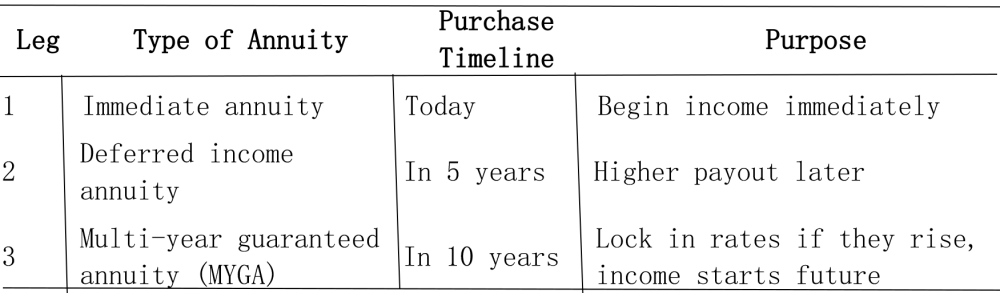

🏗️ Step-by-Step: How to Build a Simple 3-Leg Ladder

Here’s an example for a 65-year-old retiree in 2025:

This combination provides near-term income, mid-term security, and long-term growth.

This combination provides near-term income, mid-term security, and long-term growth.

🛠️ Customizing Your Annuity Ladder for Maximum Impact

Match Timing to Income Goals

- Early retirees (60–65): Use longer deferrals.

- Mid-retirees (65–75): Blend immediate and mid-term contracts.

- Late retirees (75+): Focus on stability and guaranteed payouts.

Use Riders and Contract Features Wisely

- Inflation riders increase payouts annually.

- Liquidity riders allow limited withdrawals.

- Death benefits protect heirs from losing out.

Smart Tax Positioning

- Place tax-deferred annuities in retirement accounts.

- Use non-qualified funds for tax-advantaged income treatment.

🚫 Common Mistakes to Avoid

1. Putting Too Much Into One Type

Balance fixed, immediate, deferred, and indexed annuities to avoid overexposure.

2. Ignoring Fees and Surrender Periods

Always review costs and how long your money is locked up before buying.

3. Forgetting About Inflation

Choose some contracts with inflation riders or defer income to boost future purchasing power.

🧠 Final Thoughts: Is Annuity Laddering Right for You?

If you’re looking for a way to:

- Protect against inflation

- Maximize interest rate potential

- Guarantee income at every stage of retirement

…then annuity laddering could be your ideal strategy in 2025.

🔗 Next Steps

- 📘 Start with our Beginner Annuity Planning Guide

- 🔍 Read Why Annuities Are the New Retirement Anchor in 2025

- 🧮 Try our Annuity Laddering Calculator to see what your retirement income could look like.

➡️ Want help building your annuity ladder? Reach out to a licensed retirement income specialist or contact us today at RetireOnPassive.com.