Why Annuities Are the Retirement Anchor in 2025

Why Annuities Are the Retirement Anchor in 2025

🏦 What Is an Annuity?

A contract that turns part of your savings into guaranteed income—for life or a set time.

🌟 Why Are Annuities So Popular Now?

✅ Trend 📈 Reason

Longevity People are living longer—more income needed

Market Volatility Stocks are unpredictable, income isn’t

Inflation Annuities can offer inflation-adjusted payouts

SECURE Act 2.0 New laws make annuities easier to use in retirement plans

🔍 3 Questions to Ask Before Buying

🔍 3 Questions to Ask Before Buying

- When do I need the income—now or later?

- Do I want safety, growth, or both?

- Am I OK locking up some money?

✅ 2025 Pro Tip:

Use annuities for essential expenses, and invest the rest for growth.

Think of it as building your “retirement paycheck.”

🧭 Annuities for Beginners: 5-Step Starter Guide (July 2025 Edition)

Step 1: Understand What an Annuity Really Is

An annuity is a contract with an insurance company. You give them money now (either as a lump sum or over time), and in return, they promise to pay you a set income later—usually during retirement.

Think of it like this:

🔒 You “lock in” some of your savings to turn into future paychecks.

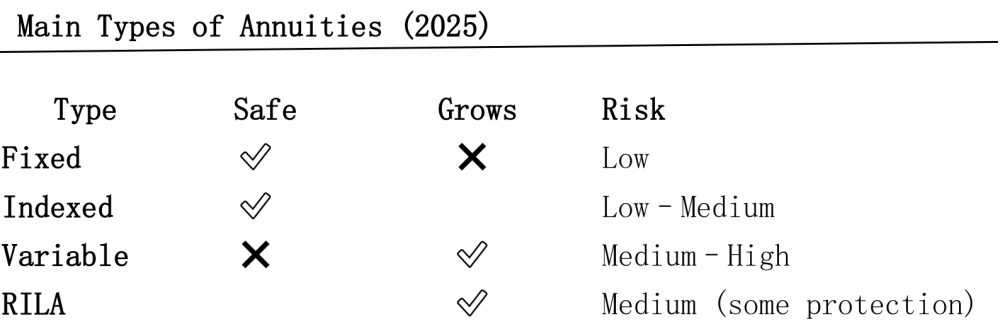

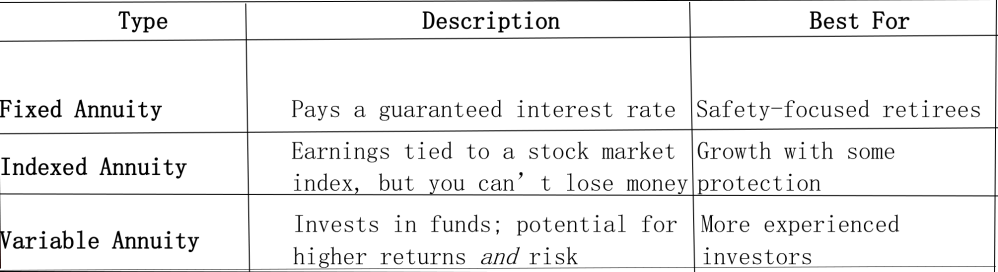

Step 2: Know the 3 Main Types of Annuities

Here’s the simplest way to break it down:

💡 New in 2025: “RILAs” (Registered Indexed-Linked Annuities) are a hybrid—offering partial market upside with limited downside.

Step 3: Know Why People Choose Annuities Now

In 2025, millions of retirees are choosing annuities because:

- 🧓 They’re worried about outliving savings

- 📉 They’re tired of market swings

- 🛡️ They want guaranteed income to cover essentials

- 🏛️ New laws (like SECURE Act 2.0) made annuities easier to use inside retirement plans

Step 4: Ask Yourself These Questions

Use these prompts before buying:

- ✅ Do I want a guaranteed income for life?

- ⏱️ When do I want the income to start—now or later?

- 🔁 Do I want flexibility or am I OK locking up the money?

- 🔍 Do I understand the fees and fine print?

- 🧑💼 Should I talk to a fee-only advisor (someone who doesn’t make commission)?

Step 5: Take Action

Start with small steps:

📄 Download a free annuity evaluation worksheet (I can help you find one!)

💬 Ask your employer or advisor if annuities are available in your 401(k)

👀 Compare simple annuities on trusted websites (like Blueprint Income or Fidelity)